In India, infertility treatments like in vitro fertilization (IVF) are becoming more and more popular, yet many couples are still concerned about the exorbitant expense. Thankfully, a few of insurance companies have started to cover IVF procedures under certain health plans. We explore the insurance plans that cover IVF in India in this extensive guide, along with the requirements for eligibility, expenses, and the application process.

Understanding IVF Coverage in India

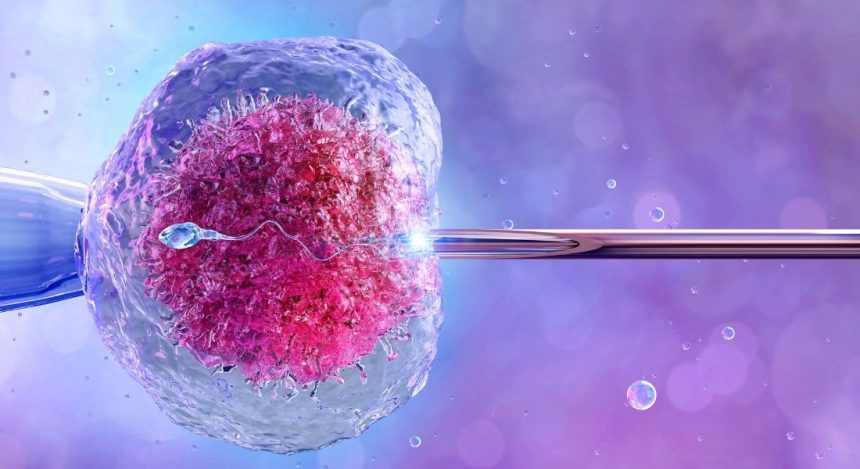

Retrieving eggs, fertilizing them in a lab, and then implacing the resultant embryo into the uterus is the convoluted medical process known as IVF. Excluding drugs and other operations, IVF therapy in India costs anywhere from ₹1,00,000 to ₹3,50,000 each cycle. Given the financial load, IVF insurance may provide couples undergoing fertility treatments great respite.

In vitro fertilization (IVF) Health Insurance Plans in India

Although conventional Indian health insurance policies usually exclude fertility treatments, certain companies have developed plans including IVF coverage either as an add-on or as part of maternity benefits. Here are some of the top insurance companies providing IVF coverage:

1. Star Health Insurance – Assisted Reproduction Treatment Coverage

Policy: Star Women Care Insurance Policy

Coverage: Provides coverage for infertility treatments, including IVF for women aged 18-45.

Conditions: A waiting period of two years applies before availing of IVF coverage.

2. Digit Health Insurance – Fertility Treatment Cover

Policy: Digit Health Care Plus

Coverage: Offers IVF treatment under maternity benefits in higher-tier plans.

Conditions: Coverage is subject to specific terms and conditions, including a waiting period of 3-4 years.

3. ManipalCigna ProHealth Insurance

Policy: ManipalCigna ProHealth Prime

Coverage: Covers fertility treatments as part of its maternity benefits in select plans.

Conditions: Pre-existing infertility conditions may not be covered.

4. Aditya Birla Activ Health Platinum Plan

Policy: Aditya Birla Health Insurance

Coverage: Covers medically necessary infertility treatments, including IVF, IUI, and ICSI.

Conditions: Requires pre-authorization and specific medical criteria.

5. Care Joy Maternity Insurance

Policy: Care Health Insurance (Joy Maternity)

Coverage: Provides limited IVF coverage under maternity benefits.

Conditions: Applicable only after a waiting period of 3 years.

Considerations for IVF Insurance Choice

When choosing an insurance plan for IVF, give the following some thought:

- Waiting Period

Before policyholders may access IVF benefits, most insurance impose a waiting period of two to four years. Make sure the waiting times fit your goals for reproductive therapy. - Coverage Scale

To find out whether IVF treatments sufficiently cover the cost of operations, drugs, and hospital fees, check the maximum amount covered. - Exclusions and Restraints

Many insurance prohibit coverage for experimental therapies, donor egg/sperm use, and pre-existing infertility issues. Before you buy, give the insurance terms great thought. - Network Clinues and Hospitals

Make sure the insurance company you choose ties together with reputable IVF-specialized hospitals and clinics. - Documentation and Claim Procedure

Knowing the claim process is really vital. To handle claims for IVF coverage, most insurers call for medical records, doctor’s prescriptions, and invoices.

How to Apply for IVF Insurance in India?

Applying for IVF insurance is a straightforward process. Here’s a step-by-step guide:

- Compare Policies: Research different insurance providers offering IVF coverage.

- Check Eligibility: Review the policy’s eligibility criteria, waiting period, and coverage terms.

- Consult an Expert: Speak to an insurance advisor or fertility specialist to understand which policy best suits your needs.

- Purchase the Policy: Apply online through the insurer’s website or visit their nearest branch.

- Submit Required Documents: Provide necessary documents like medical history, infertility diagnosis reports, and age proof.

- Claim Process: If required, follow the insurer’s claim submission procedure with all relevant medical records.

Are IVF expenses tax deductible in India?

by Section 80D of the Income Tax Act, medical insurance premiums eligible for tax deductions; IVF procedures are usually not tax-deductible unless covered by a health insurance plan.

Final Thoughts: Is IVF Insurance Worth It?

IVF insurance may greatly reduce financial anxiety for couples undergoing assisted reproduction given the great expense of fertility treatments. If you are considering IVF, it would be wise to make investments in a thorough health insurance package with reproductive features.

See a health insurance specialist for the most recent information on IVF insurance in India; before making a purchase, carefully study policy specifics.